Faculty Recruitment Allowance (FRA)

New Academic Senate faculty are eligible for a Faculty Recruitment Allowance (FRA). The standard FRA amount is set for each recruitment year by the Office of the President and is fixed at the time of the appointment. This fund is intended to assist faculty in purchasing a home by providing them with a salary supplement to be used for a down payment. The funds are normally available when the buyer enters into escrow. Since this is a salary supplement, it is taxable and subject to withholding taxes at the time of payment.

Zero Interest Program Loan

Faculty may choose to receive the Faculty Recruitment Allowance as a 10-year Zero Interest Loan (ZIP). This is a forgivable loan with no monthly payment. 10% of the original loan amount would be forgiven annually over 10 years, if the faculty member is in good standing. If the specified conditions are met every year over the 10-year loan term, it is expected that no balance would be due at the end of the loan term. The amount forgiven in each year is subject to taxes in that year. Faculty are encouraged to take the FRA as a ZIP loan since a lump-sum payment of the FRA would have a significant amount deducted for taxes. Note: The ZIP loan option will be available to any faculty member who was promised and has not yet utilized an FRA, regardless of when they were appointed. Faculty who have used a portion of their FRA allowance may apply the remaining amount to a ZIP loan. The minimum loan amount is $10,000.

Repayment

Beginning with faculty who start on July 1, 2023, those receiving the FRA will be entitled to retain the full amount received if they remain employed by UC Santa Barbara for five years after the funds are disbursed. If they terminate their employment with UCSB before this five-year period expires, a portion of the Allowance, before withholding, will be subject to repayment, on a pro-rated basis. This will be calculated at 20% per year for the five-year period. (Faculty who received an FRA commitment before July 1, 2023 are not bound by these repayment obligations.)

For faculty electing to take the FRA as a ZIP loan, they must repay any remaining loan balance that has not been forgiven if they separate from the University before the forgiveness period has ended, consistent with loan terms.

Other Housing Expenses

The FRA/ZIP loan allowance is designed to help faculty secure permanent housing by providing them with funds for a down payment on the purchase of a home. They may request permission to use up to 20% of the FRA for other housing needs, such as rent, with a maximum of 10% allowed in a single year. Faculty are strongly encouraged to retain these funds until they can use them for a down payment.

UC Mortgage and Loan Programs

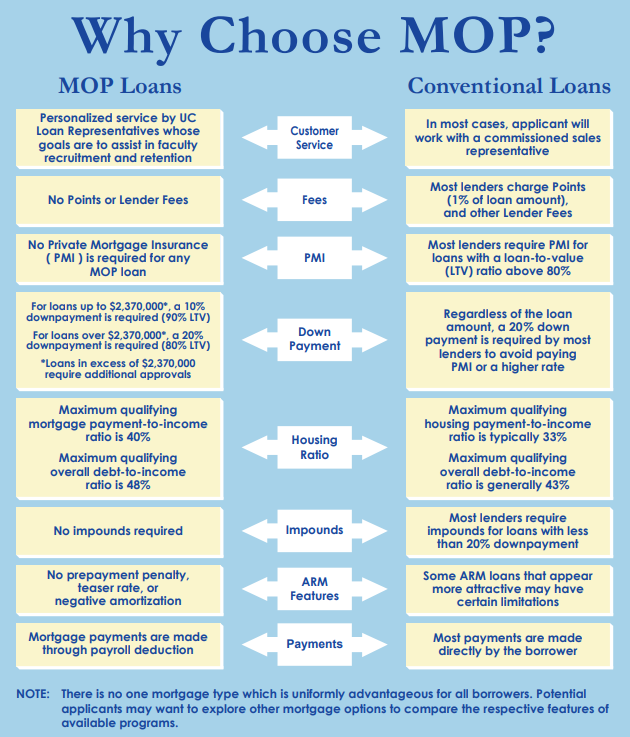

The Office of Loan Programs designs, delivers, and manages housing assistance programs for the recruitment and retention of faculty in support of the education, research and public service missions of the University of California.

New faculty are eligible to apply for a Mortgage Origination Program (MOP) loan for a home purchase. Participation is limited to one MOP per household. The actual amount of the loan will be based on qualification criteria as determined by the University, up to the current maximum amount determined by University of California Office of Loan Programs.

MOP currently allows up to 90% financing based on the lesser of the purchase price or appraised value for loan amounts up to the max indexed threshold ($2,370,000 as of March 1, 2022).

MOP eligibility is offered for an initial three-year period, which is renewable. In rare cases, such as a retention case, a second MOP loan may be authorized. For more information, please visit the UCOP Office of Loan Programs.

Mortgage Origination Program (Standard MOP)

MOP, also known as Standard MOP, is a fully-amortizing first deed of trust loan with a one-year adjustable interest rate based upon an internal University index (MOP Index).

5/1 Mortgage Origination Program (5/1 MOP)

The 5/1 Mortgage Origination Program (5/1 MOP) is an alternative product to the Standard MOP. 5/1 MOP is a fully-amortizing first deed of trust loan that offers an initial fixed interest rate and payment for the first 5 years of the loan, after which the loan converts to a Standard MOP for the remaining loan term. During the initial loan process, you will have the option to select the 5/1 MOP product.

Supplemental Home Loan Program (SHLP)

The Office of the President has a centrally-funded Supplemental Home Loan Program Pool (CF-SHLP) that may be available for a limited number of high-priority cases where housing is a key recruitment consideration and the individual is not able to qualify for a home purchase. The program has specific criteria and terms, e.g. it is a second trust deed which may only be used for a primary residence and has a maximum term of 10 years (other limitations and terms may apply).

Relevant Resources

Faculty may investigate the possibility of a 403(b) Plan loan for the purpose of purchasing a principal residence. In addition, the Coastal Housing Partnership is a nonprofit organization dedicated to serving the community by assisting local employees with their home buying needs. It offers information about options and benefits, and educational resources as employees navigate their way through the home buying process, and a network of service professionals to assist employees in their search for area housing.

For more information, please reach out to the Faculty Housing Contacts.

University & Community Housing Services Rental Listings

The UCSB University & Community Housing Services Rental Listings provides information about rental listings in the community.